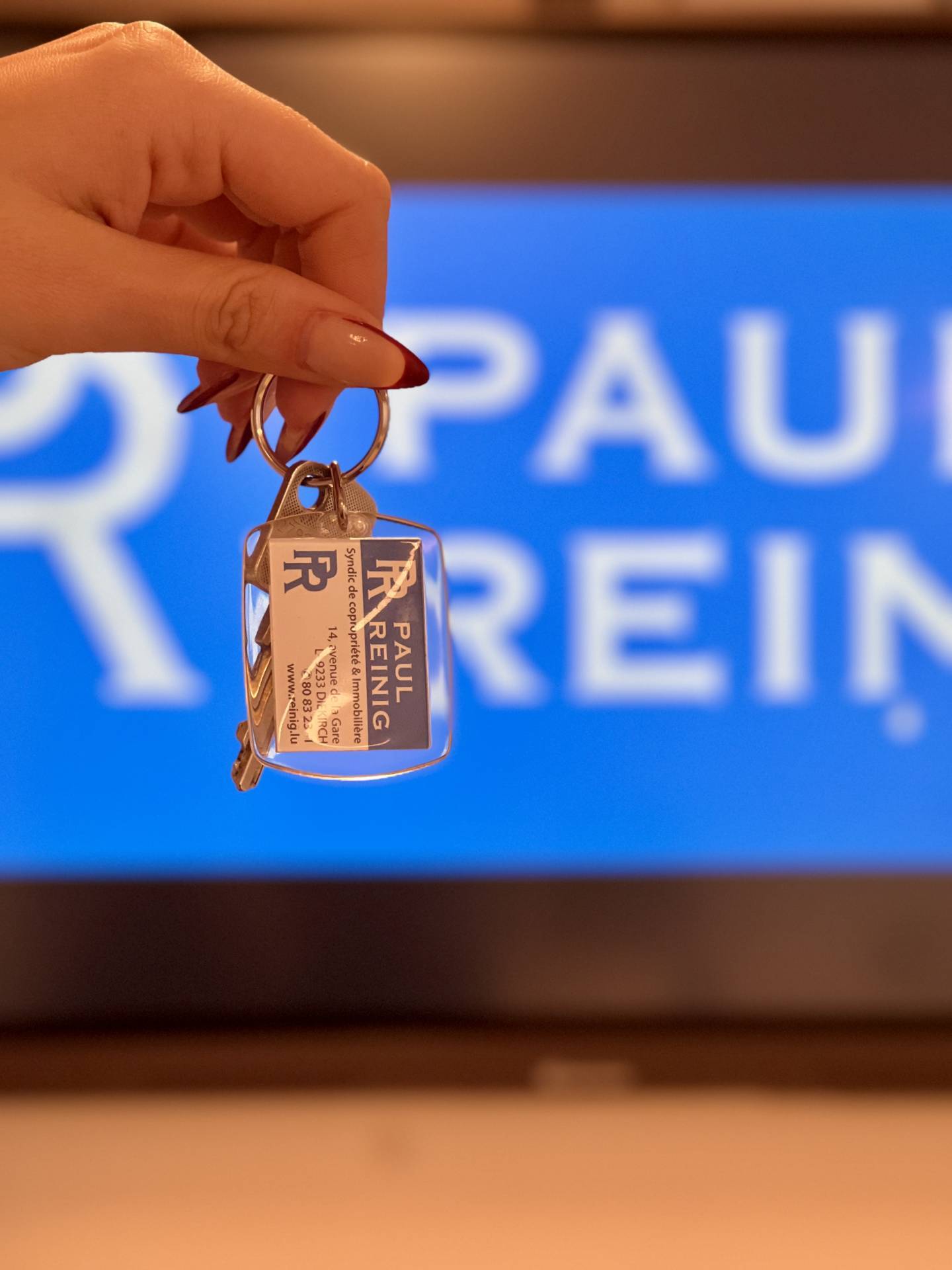

With HOME home insurance, you are fully covered as a homeowner or tenant, whether for a house or an apartment.

Why choose HOME insurance?

Whether you are a tenant or an owner, HOME adapts to your home and lifestyle.

Contact us for a personalized quote and protect your property.

Customize your car insurance according to your needs with our basic coverage and additional options. Choose insurance that perfectly matches your expectations.

Get the car insurance that meets your needs and protects you in every situation.

Get expert advice here!

Remaining balance insurance covers the amount of a mortgage loan. In the event of death or disability, the insurance takes care of repaying the loan. The insured amount changes in parallel with the outstanding balance of the loan.

With remaining balance insurance, you can secure your loan and protect your family from unexpected financial burdens.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.